✅ Introduction

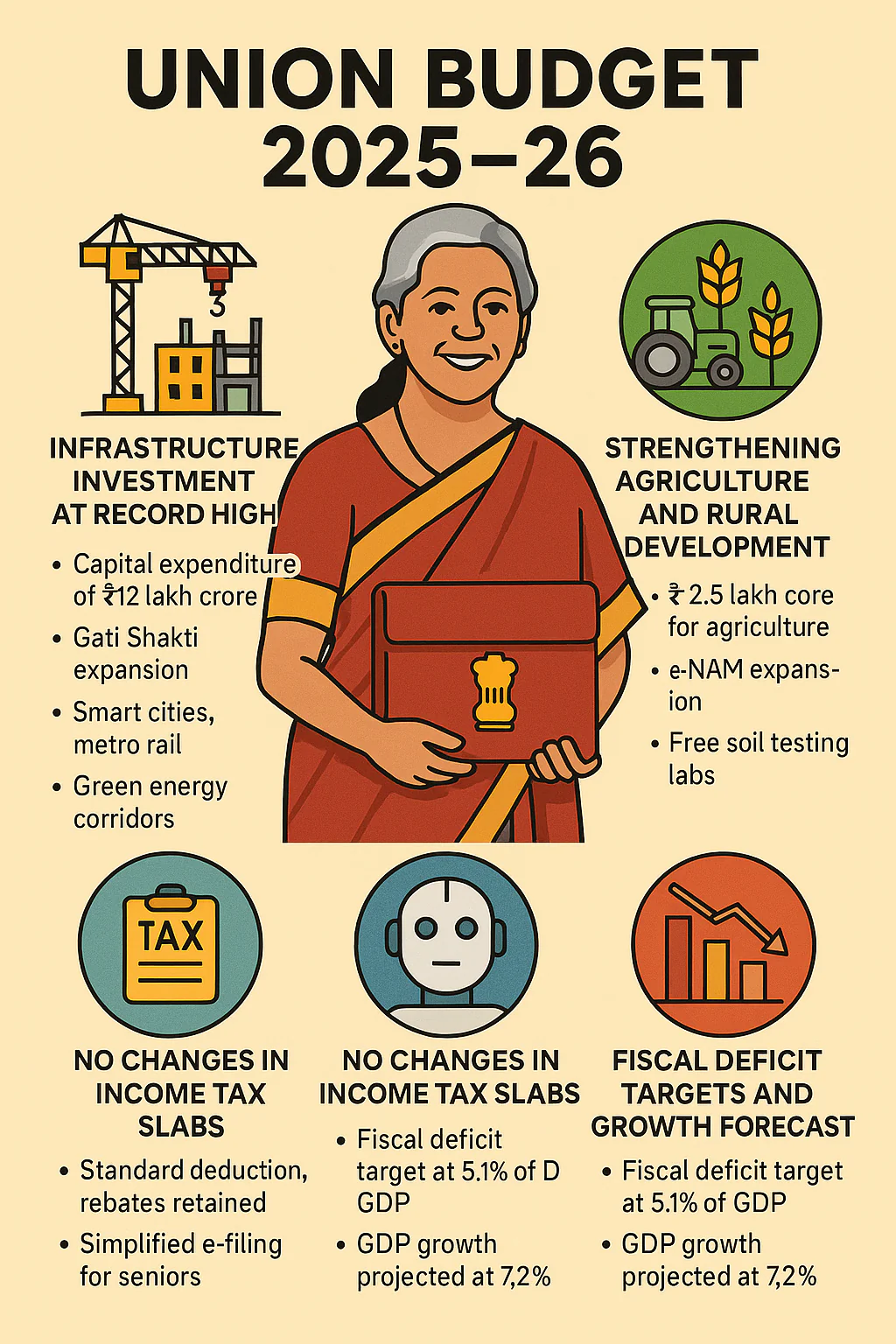

On July 5, 2025, Union Finance Minister Nirmala Sitharaman presented the Union Budget 2025–26 in Parliament. This is the first budget of Prime Minister Narendra Modi’s third term, and it lays out a strategic plan to drive economic growth, promote digital innovation, and strengthen rural development.

While many citizens hoped for tax relief or revised income tax slabs, the government has taken a broader and long-term approach. The focus is clearly on building infrastructure, modernizing agriculture, and investing in Artificial Intelligence (AI)—a sign of India preparing for the digital and industrial future.

This blog breaks down the key highlights and explains why this budget matters to every Indian.

https://www.indiabudget.gov.in/

https://www.indiabudget.gov.in/doc/Budget_at_Glance/budget_at_a_glance.pdf

🌍 Top 10 Technologies Changing the World in 2025

Google AI Features 2025 – Groundbreaking New AI Innovations Transforming Daily Life and Work

Pahalgam Terrorist Attack 2025: A Tragic Day in Kashmir’s Tourist Haven

🛤️ Infrastructure Investment at Record High

One of the most talked-about features of the Union Budget 2025–26 is the massive allocation of ₹12 lakh crore for capital expenditure. This is the highest ever in India’s budget history and signals a strong push for improving physical infrastructure across the country.

Key Projects:

Expansion of the Gati Shakti Master Plan, which covers highways, expressways, ports, railways, and airports.

Boost to urban metro rail networks in cities like Mumbai, Bengaluru, and Hyderabad.

Funding for smart city development, promoting urban housing and intelligent mobility systems.

New green energy corridors to support solar and wind energy transport.

🟢 Why it matters: These developments will not only generate employment but also improve business efficiency and attract international investments. Better logistics will support the “Make in India” initiative and reduce costs for manufacturers.

🌾 Strengthening Agriculture and Rural Development

The government continues to support rural India, with ₹2.5 lakh crore allocated for agriculture and allied services.

Highlights:

Smart irrigation systems and water conservation projects introduced.

Wider implementation of e-NAM (National Agriculture Market), connecting more farmers to digital trade.

Launch of free soil testing labs for better crop planning.

Expansion of crop insurance schemes with better and faster claim settlement.

Support for farmer producer organizations (FPOs) to improve collective bargaining.

🟢 Why it matters: Agriculture is the backbone of India’s economy. These steps help farmers increase productivity, reduce risk, and improve income. It also helps bridge the rural-urban development gap.

🤖 The Rise of AI: National AI Mission Funded

The 2025–26 budget gives a big thumbs up to technology and innovation, especially Artificial Intelligence (AI).

Key Highlights:

₹20,000 crore committed to the National AI Mission.

Establishment of 15 AI Centres of Excellence in top universities and research hubs.

Government support for startups in deep tech, robotics, and automation.

AI applications encouraged in sectors like healthcare, education, agriculture, and governance.

🟢 Why it matters: India wants to be a global leader in AI, which will help create skilled jobs, boost innovation, and automate public services efficiently. These efforts also position India to lead in the 4th industrial revolution.

💼 No Changes in Income Tax Slabs

Despite expectations of personal income tax relief, the Union Budget 2025–26 has kept tax slabs unchanged.

Key Points:

Standard deductions and rebates under both the old and new tax regimes continue.

Senior citizens benefit from a simplified e-filing process and refund system.

The Income Tax Department has pledged faster refunds and better digital service support through its updated IT portal.

🟢 Why it matters: While there is no direct benefit in tax amounts, the stability in tax policy gives salaried individuals and businesses more certainty for financial planning.

📉 Fiscal Deficit Targets and Growth Forecast

The government is focusing on fiscal discipline while ensuring that the economy continues to grow at a strong pace.

Highlights:

Fiscal deficit target has been reduced to 5.1% of GDP, from 5.8% the previous year.

India’s GDP growth forecast for FY 2025–26 is 7.2%, among the highest for large economies.

The government plans to maintain low inflation, manage public debt, and encourage private investment.

🟢 Why it matters: A lower fiscal deficit signals responsible spending, which improves India’s credit rating and makes it more attractive for foreign investors. It also strengthens the rupee and helps keep inflation under control.

🔍 Conclusion

The Union Budget 2025–26 is a well-planned and growth-oriented roadmap that balances ambition with responsibility. By investing heavily in infrastructure, rural upliftment, and technology, the government is laying the foundation for a stronger, smarter, and more inclusive India.

While there may be no personal income tax relief, the long-term benefits of this budget can be seen in better jobs, better roads, smarter cities, stronger rural economies, and a future-ready digital ecosystem. It reflects India’s steady march toward becoming a $5 trillion economy Union Budget 2025–26.